life insurance face amount vs death benefit

With some types of life contracts whole universal the face amount can grow a higher death. This is also known as option A or option 1.

Ad Exclusive term life insurance from New York Life.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

. Ad Living insurance offers a traditional insurance benefits plus an early payout option. By the same token if it would take 800000 to replace the economic support the man offers his family then the life insurance agent will insist the man get a policy with this amount of death. When you purchase a life insurance policy you pay premiums to a life insurance company in order to protect your family from the financial burden associated.

Ive never heard of such a death benefit and dont believe there is one. The face amount can be changed in some instances though its generally easier to. That leaves only two possibilities.

Youre eligible to apply for exclusive term life insurance from New York Life. The face amount is the initial amount of money which is stated on the face of the contract that will be paid in a death claim. Most life insurance policies intend to provide financial protection for loved ones after you pass.

Ad Make Sure That Your Loved Ones Are Cared for with a Policy from Mutual of Omaha. The face amount is the initial amount of money stated on the life insurance application when you first buy the policy and is intended to be paid as a death benefit to your. The face amount can.

Up to 100000 in coverage. At the beginning of the policy the face value and the death benefit are the same. 2 The face value of life insurance is.

Youre eligible to apply for exclusive term life insurance from New York Life. The face value of a life insurance policy is the death benefit. Insurer will absorb the cash value of your whole life insurance policy after you die and your beneficiary will get the death benefit.

The death benefit of a life insurance policy represents the face amount that will be paid out on a tax-free basis to the policy beneficiary when the insured person dies. Up to 100000 in coverage. The face amount is the initial death benefit on a life insurance policy.

The face value is typically how much your life insurance beneficiaries will receive if you die while your policy is in force. See Our 1 Pick. So if you buy a policy with a 500000 face value in most.

All life insurance policies have a face amount which is also called the death benefit this is the amount thats paid to your beneficiaries after you die. But as the cash value of the policy changes over time it can alter the total death benefit either above or. The term Face Amount is similar in nature.

A BBB Rated Companies. They both reflect the amount of money that the insurance company will pay out in the. Face value is different from cash value which is the amount you receive when you surrender your.

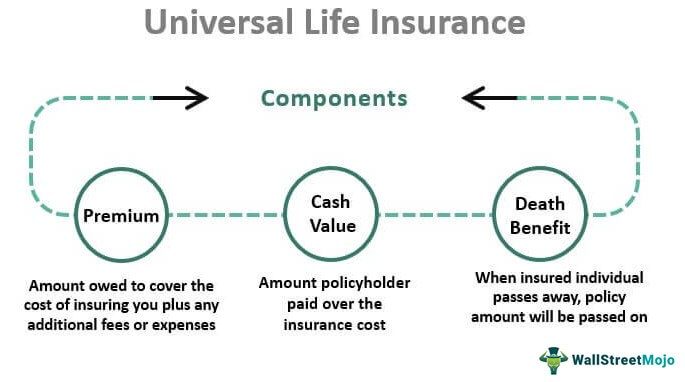

Universal life insurance allows policy owners to rather easily. You can borrow or withdraw. The face amount of a whole life insurance policy is the death benefit but it isnt necessary for it to remain the same since the time the policy was signed.

With this option your beneficiary. The definition of life insurance death benefit is the amount of money payable to the beneficiary or beneficiaries listed on a life insurance policy upon the death of the insured. 2021s Top 5 Life Insurance.

Find The Right Plan For You. Ad 5 Best Rated Life Insurance Plans 2021. Get Instantly Matched with Your Ideal Life Insurance Plan.

Face Amount vs Death Benefit. Ad The Comfort of a Reliable Life Insurance is Priceless. It refers to the initial coverage amount of a policy.

Level death benefit. The face amount of a policy is the amount you request when you apply for life insurance. If you decide to borrow money from your whole life or universal life insurance policy your coverage will not be terminated unless you decide to terminate it.

What is the Face Amount of Life Insurance. The initial amount of money claimed by the beneficiaries on account of. Apply 100 Online In 5 Min.

The face amount of a life insurance policy is frequently the same as its death benefit. I want to note that a universal life insurance death benefit option is different from a death benefit amount change. First your mother has a Federal Employees Group Life Insurance.

The death benefit is designed to stay level throughout the life of the policy. Keep in mind that face amount and paid death benefits are similar. Collect up to 50 of your benefit while you are living if you become seriously ill.

How Life Insurance Face Amount and Death Benefits are Calculated. The face amount and thereby the death benefit can. Ad Exclusive term life insurance from New York Life.

Life Insurance Vs Annuity How To Choose What S Right For You

Pin On Insurance Marketing Humor Estate Planning Chronic Critical Illness Annuities Tax Savvy Make Money

Annuity Vs Life Insurance Similar Contracts Different Goals

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

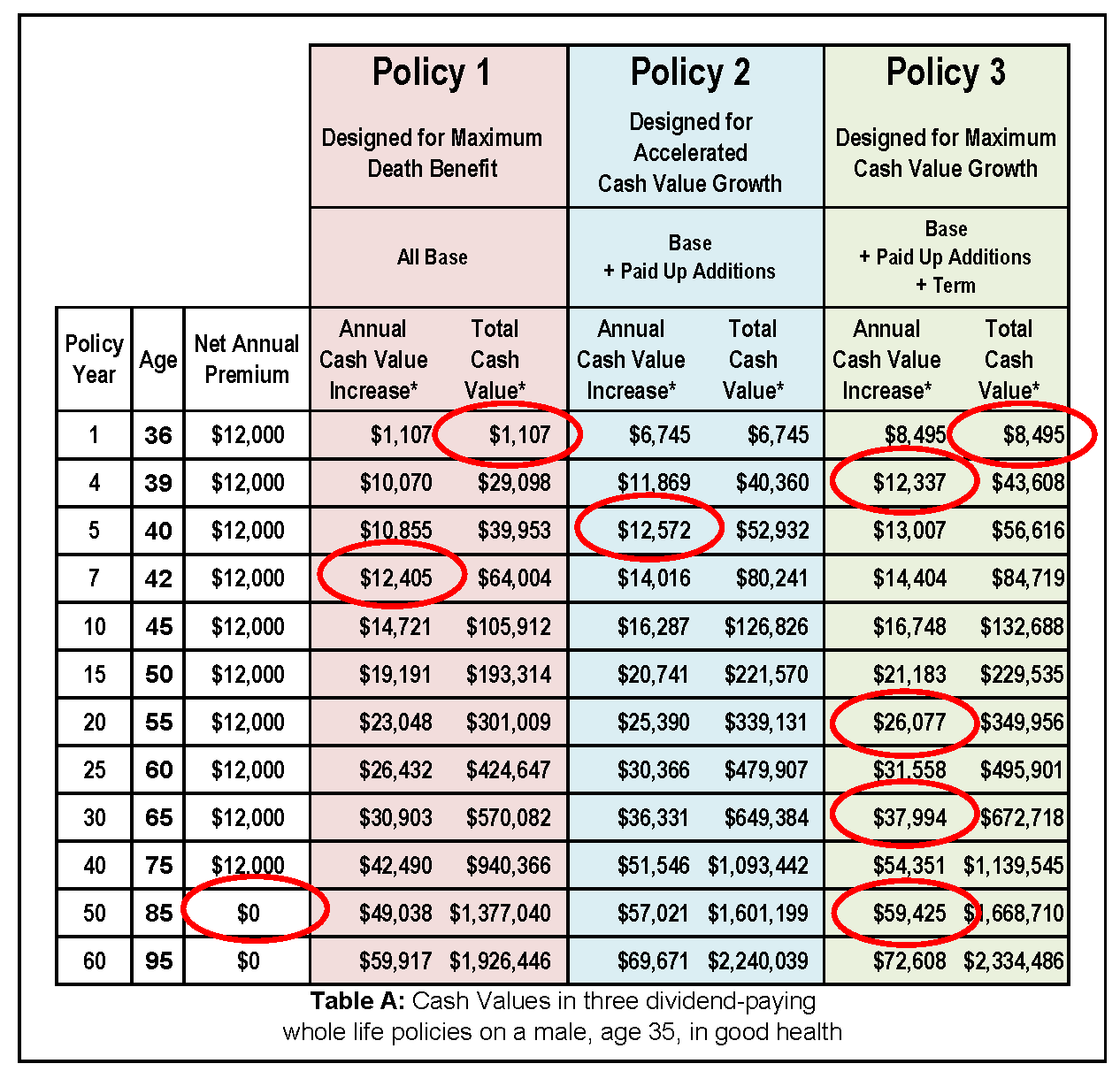

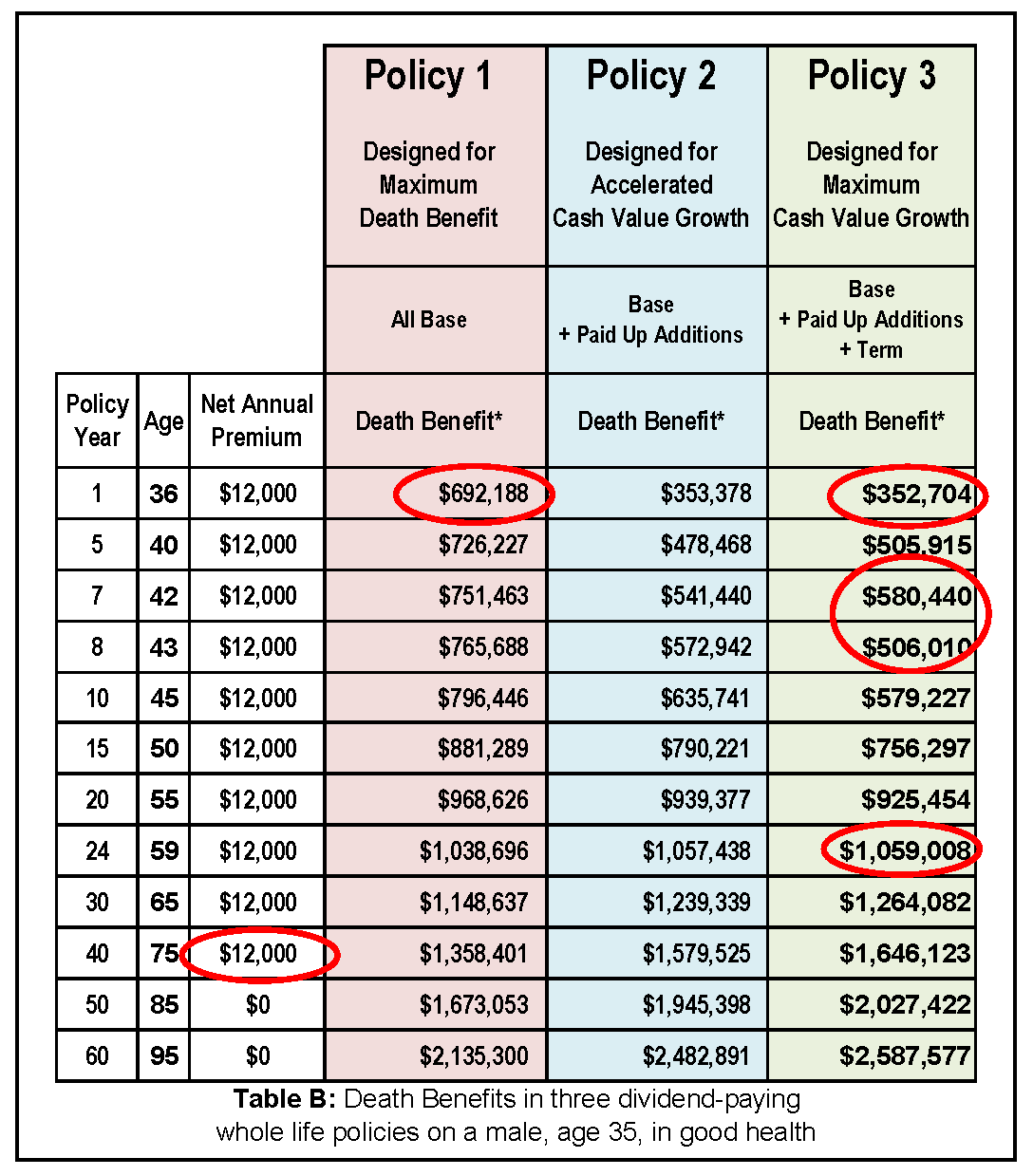

What Are Paid Up Additions Pua In Life Insurance

Paid Up Additions Work Magic In A Bank On Yourself Plan

How To Choose A Life Insurance Beneficiary

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

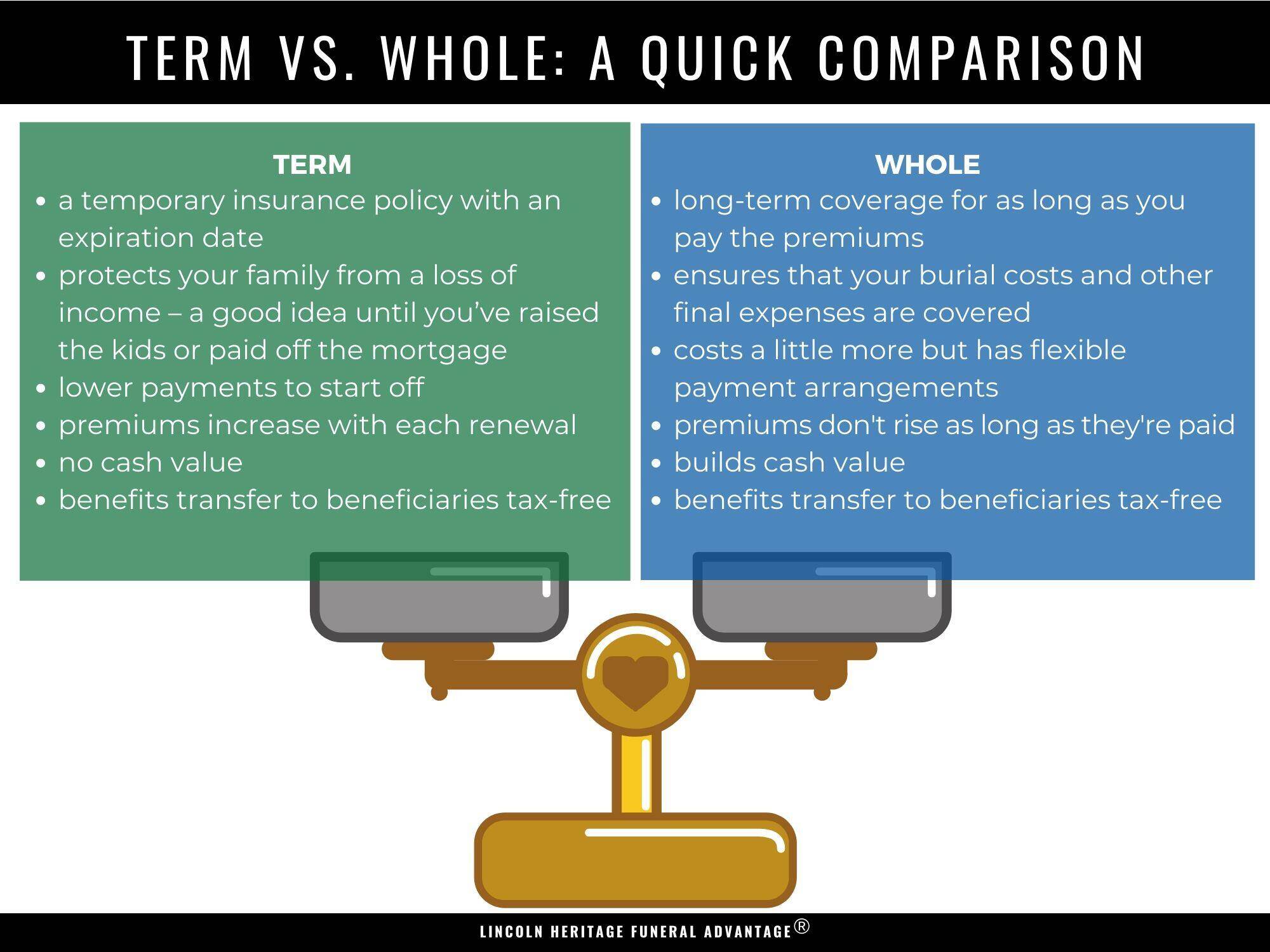

Term Vs Whole Life Insurance 2022 Guide Definition Pros Cons

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

Life Vs Health Insurance Choosing What To Buy

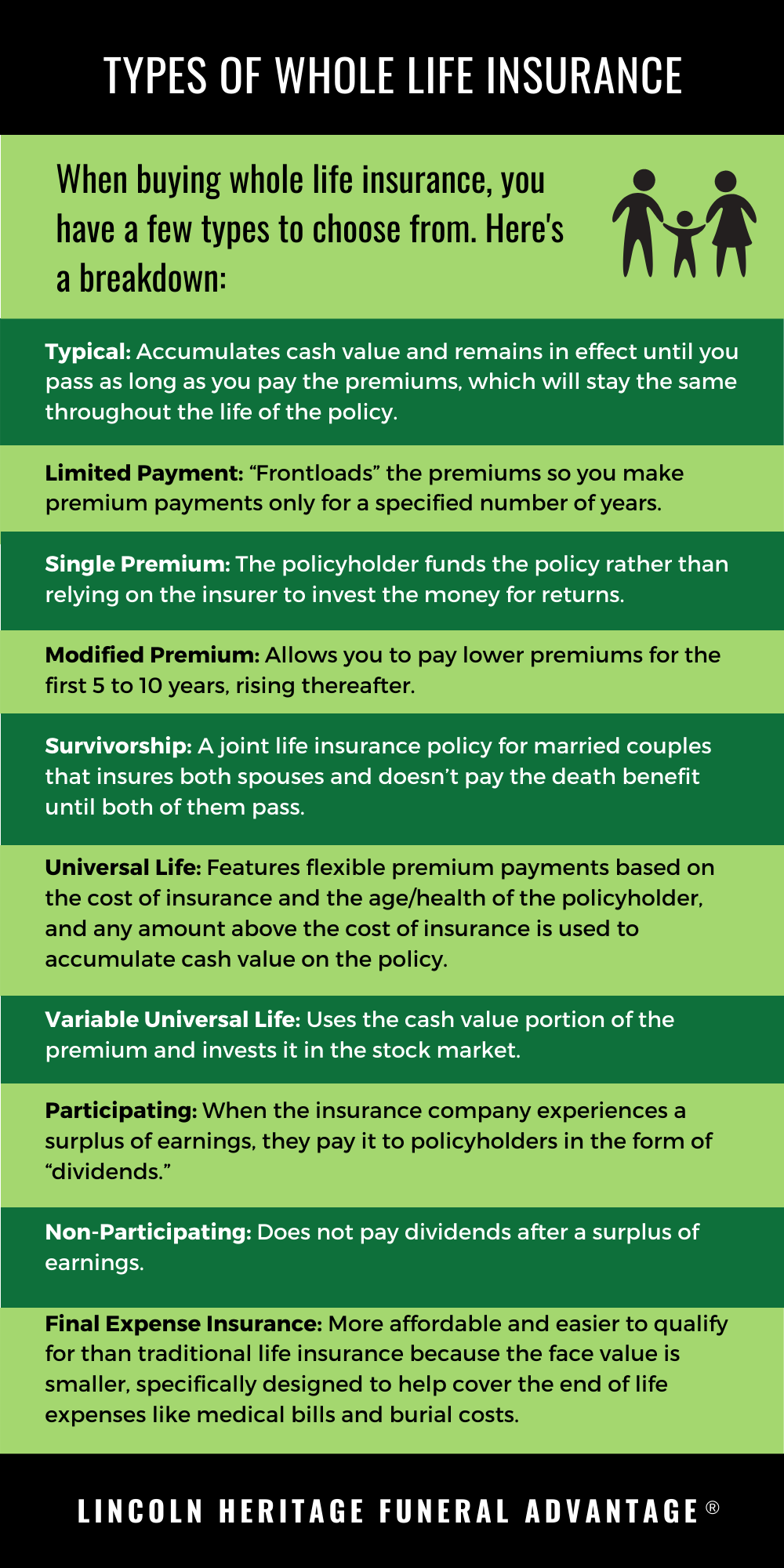

What Is Whole Life Insurance Cost Types Faqs

Paid Up Additions Work Magic In A Bank On Yourself Plan

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Universal Life Insurance Definition Explanation Pros Cons

Whole Life Insurance Life Insurance Glossary Definition Sproutt

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)